Entry Type 86 is a standardized classification used primarily in data management and bibliographic records. It connects users to critical information, ensuring accuracy and consistency in documentation. Understanding Type 86 can significantly enhance the way individuals and organizations manage and retrieve data.

This entry type is essential for cataloging various resources, particularly in academic and research settings. Mastery of Entry Type 86 facilitates better organization, allowing researchers to locate necessary materials with ease. Engaging with this topic opens the door to more efficient data handling practices.

As users navigate through complex information landscapes, recognizing how Type 86 improves record-keeping becomes invaluable. Those who comprehend its implications will find themselves better equipped to tackle data challenges throughout their professional and academic endeavors.

Overview of Entry Type 86

Entry Type 86 represents a specific code used for the classification of data in various financial and logistical systems. It primarily deals with identifying transactions or goods, facilitating efficient tracking and management within regulatory frameworks.

History and Development

Entry Type 86 emerged from the need for standardized classifications in the logistics and finance sectors. Initially introduced in the early 2000s, it provided a structured way to categorize transactions and goods for analysis.

Over the years, it evolved through feedback from industry stakeholders. This evolution led to updates that improved interoperability between systems, ensuring better compliance with international standards. These changes aimed to enhance the consistency and clarity of financial reporting, making it easier for businesses to adopt the classification.

Regulatory Framework

The regulatory framework surrounding Entry Type 86 is influenced by several international standards. Compliance with financial and logistics regulations necessitates a thorough understanding of how Entry Type 86 fits within these guidelines.

Organizations must align with standards set by governing bodies to maintain accuracy in reporting and transaction processing. This includes ensuring that data classified under Entry Type 86 adheres to the General Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Regular audits and updates may be required to comply with evolving regulatory requirements.

Implementation and Processing

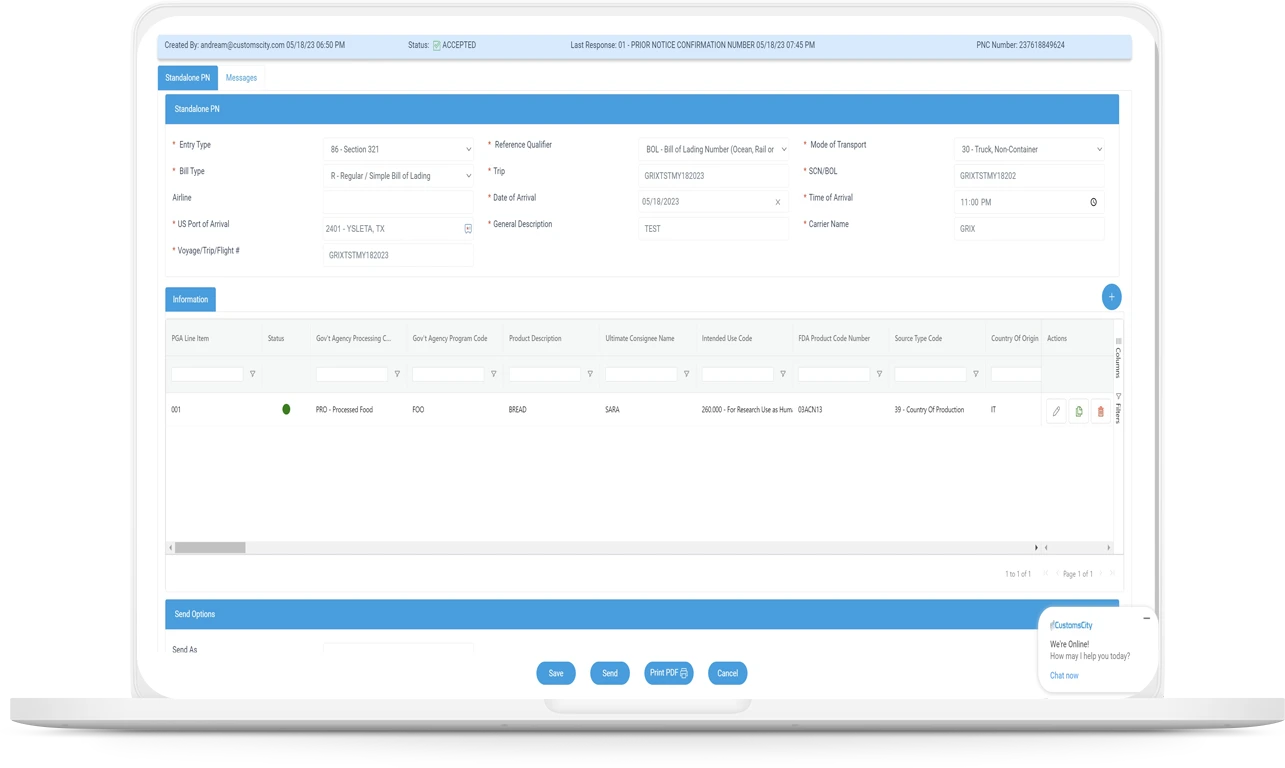

The implementation and processing of Type 86 entries involve specific eligibility criteria, customs clearance procedures, and clearly defined duties and responsibilities of trade parties. Each aspect is crucial for ensuring compliance and smooth operations in international trade.

Eligibility Criteria for Type 86 Entries

Type 86 entries are typically reserved for goods that meet certain eligibility standards. These standards often include compliance with specific classification, value limits, and country of origin requirements.

To qualify, importers must demonstrate proper licensing and adherence to relevant trade regulations. Additionally, documentation such as invoices, packing lists, and permits must be accurate and complete.

Meeting these criteria helps to streamline the processing of entries and minimizes the risk of delays or penalties during customs clearance.

Customs Clearance Procedure

The customs clearance procedure for Type 86 entries encompasses several steps designed to ensure regulatory compliance. Initially, the importer must submit a complete entry package, including all relevant documentation.

Customs officials will review the entry for accuracy and completeness. They may also require additional information or clarification before granting clearance.

Once the entry is approved, the importer must pay any applicable duties and taxes. Timely payment is essential to avoid penalties and to ensure the smooth release of goods.

Duties and Responsibilities of Trade Parties

Trade parties involved in Type 86 entries have distinct duties and responsibilities. Importers are responsible for ensuring that all required documents are properly prepared and submitted.

They must also maintain accurate records of transactions and compliance efforts for auditing purposes.

Customs brokers often assist in navigating the complexities of customs regulations. Their role includes preparing and filing documentation, advising on compliance, and coordinating with customs officials to facilitate clearance.

Failure to fulfill these responsibilities can result in delays, increased costs, and potential legal consequences.