Accounting and billing software have become essential tools for businesses worldwide. With advancements in technology, these tools are evolving rapidly, shaping the future of financial management. In this blog, we will explore the key trends and innovations in invoicing and billing software, such as blockchain in accounting, mobile-first billing solutions, and subscription-based invoicing tools. Let’s dive into the future of accounting software and discover what’s in store.

The Rise of Cloud-Based Solutions

Cloud technology has revolutionized how businesses operate. In 2023, more than 60% of small and medium-sized businesses (SMBs) used cloud-based accounting software, and this percentage is expected to reach 80% by 2026. Cloud-based solutions offer real-time access to data, enabling businesses to manage their finances from anywhere. This flexibility is especially beneficial for companies with remote teams or multiple office locations.

Benefits of Cloud-Based Solutions:

- Automatic updates with new features

- Enhanced data security

- Scalability for growing businesses

Automation and Artificial Intelligence (AI)

Automation and AI are becoming integral parts of accounting software. These technologies help reduce manual errors, save time, and provide accurate financial insights. For example, AI-powered tools can categorize expenses, predict cash flow trends, and even detect fraudulent transactions.

According to a study by Gartner, by 2025, 75% of businesses will use AI-based solutions to automate accounting tasks. This shift will allow accountants to focus more on strategic planning rather than repetitive data entry.

Upcoming Billing Features Powered by AI:

- Predictive analytics for financial forecasting

- Smart invoice generation

- Personalized customer insights

Mobile-First Billing Solutions

As smartphone usage continues to grow, mobile-first billing solutions are gaining popularity. In 2022, around 45% of businesses used mobile apps for invoicing and payments, and this number is projected to increase to 70% by 2025. Mobile-friendly software allows users to create invoices, track payments, and manage finances on the go.

These solutions are particularly useful for small business owners and freelancers who often need quick access to their financial tools. Features like push notifications for overdue payments and one-tap payment reminders make mobile-first billing solutions highly convenient.

Blockchain in Accounting

Blockchain technology is transforming the accounting landscape by introducing transparency and security. By 2028, the global blockchain market in accounting is expected to reach $11.5 billion, growing at a compound annual growth rate (CAGR) of 47.2% from 2023.

How Blockchain Benefits Accounting:

- Secure and tamper-proof transaction records

- Instant verification of financial data

- Reduced risk of fraud and errors

Blockchain can also streamline invoicing by enabling smart contracts, which automatically execute payment terms once conditions are met. For instance, a freelancer could receive payment immediately after submitting a project, eliminating delays.

Subscription-Based Invoicing Tools

Subscription-based models are becoming a preferred choice for businesses of all sizes. Instead of purchasing software outright, companies can subscribe to monthly or annual plans. This model provides access to the latest features without the need for costly upgrades.

In 2023, the subscription economy was valued at $275 billion and is predicted to grow to $1.5 trillion by 2030. Subscription-based invoicing tools often include features like recurring billing, automatic payment reminders, and detailed analytics.

Advantages of Subscription-Based Tools:

- Affordable pricing with predictable costs

- Regular updates and new features

- Integration with other business tools

Integration with Other Business Systems

Modern accounting software is not just limited to bookkeeping. It integrates seamlessly with other business systems like Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), and e-commerce platforms. For example, integration with a CRM system allows businesses to automatically generate invoices based on customer interactions.

This interconnected approach helps businesses streamline operations, reduce manual work, and improve overall efficiency. According to a report by Statista, 65% of businesses will prioritize software integration by 2025.

Focus on User Experience (UX)

As competition increases, accounting software providers are focusing on delivering a superior user experience. Intuitive interfaces, customizable dashboards, and easy navigation are now standard features.

For instance, QuickBooks and Xero have introduced guided setups and tutorials to help users get started quickly. Enhanced UX not only improves user satisfaction but also reduces the learning curve for new users.

Emphasis on Data Security

With the rise of cyber threats, data security remains a top priority for accounting software developers. Advanced encryption, multi-factor authentication, and regular security audits are becoming standard practices.

In 2023, the cost of data breaches in the financial sector averaged $5.85 million per incident. To mitigate such risks, many software providers are adopting ISO-certified security measures and offering cyber insurance.

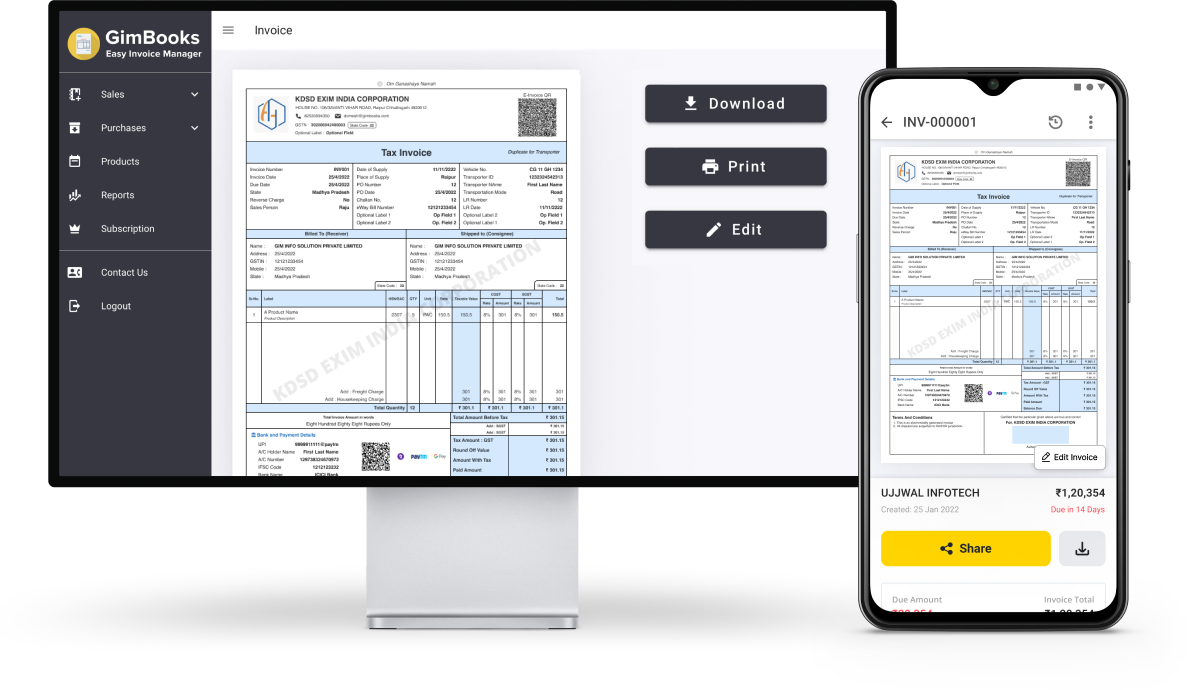

GimBook: Simplifying the Future of Billing

GimBook is at the forefront of revolutionizing accounting and billing with its cutting-edge features tailored for modern businesses. Designed with user-friendly interfaces and advanced technologies like automation, mobile-first solutions, and seamless integrations, GimBook empowers companies to manage their finances efficiently. Whether you’re a freelancer or a growing enterprise, GimBook offers innovative tools like smart invoicing, subscription-based billing, and real-time financial insights. With a commitment to security and sustainability, GimBook is the perfect partner to help businesses stay ahead in the evolving landscape of billing software.

Try GimBook today and embrace smarter, faster, and more secure billing solutions, click here: https://bit.ly/4eMIOHF

Conclusion

The future of accounting software is bright, driven by innovations in invoicing, mobile-first solutions, blockchain technology, and more. Businesses can expect smarter, faster, and more secure tools to manage their finances. By staying updated on these billing software trends, companies can leverage cutting-edge features to gain a competitive edge.

Whether you are a small business owner, a freelancer, or part of a large corporation, these advancements will make managing finances easier than ever. Embracing these trends now can help future-proof your business for the years to come.