Starting a business is an exciting journey, but managing finances can be overwhelming. For startups and entrepreneurs, keeping track of expenses, income, and invoices is essential to ensure growth and profitability. Thankfully, affordable billing and accounting software can simplify these tasks and save both time and money. Let’s dive into how these tools can help you manage your finances effectively without breaking the bank.

Why Startups Need Billing and Accounting Software

Starting a business often means working with limited resources. Entrepreneurs need tools that are simple, effective, and, most importantly, affordable. Billing and accounting software is the perfect solution. These tools can:

- Simplify Financial Management: Automate tasks like invoicing, expense tracking, and bookkeeping.

- Save Time: Free up time for entrepreneurs to focus on growing their business.

- Increase Accuracy: Reduce human errors in calculations and reporting.

- Stay Compliant: Help businesses comply with tax laws and regulations.

Did you know? According to a study, 82% of small businesses that fail cite cash flow problems as a reason. Using budget-friendly software can help avoid this issue by keeping finances organized.

Features of Affordable Billing and Accounting Software

When choosing software, startups should look for these essential features:

- Invoicing for Startups: Generate professional invoices quickly and easily. Look for tools that allow customization and automation of recurring invoices.

- Expense Tracking: Monitor where your money is going and categorize expenses for better understanding.

- Budget-Friendly Software: Ensure the software fits within your financial plan without compromising on quality.

- Bookkeeping for Entrepreneurs: Keep accurate records of all financial transactions, which is crucial for tax filing and audits.

- Cloud Accessibility: Access your financial data from anywhere, which is especially useful for remote teams.

- Scalability: Choose a tool that grows with your business, so you don’t have to switch software later.

Top Affordable Billing and Accounting Software for Startups

Here are some great options that combine affordability with functionality:

- Wave

- Cost: Free for basic features

- Why It’s Great: Wave is a popular choice for startups because it offers free invoicing and accounting features. You only pay for additional services like payroll.

- Best For: Entrepreneurs who need simple tools to manage finances.

- Zoho Books

- Cost: Plans start at $15/month (around ₹1,200 INR)

- Why It’s Great: Zoho Books offers invoicing, expense tracking, and bank reconciliation. Its user-friendly interface makes it ideal for beginners.

- Best For: Small teams looking for an all-in-one solution.

- QuickBooks Online

- Cost: Plans start at $30/month (around ₹2,500 INR)

- Why It’s Great: Known for its robust features, QuickBooks is perfect for scaling businesses. It offers automated invoicing, expense tracking, and detailed financial reports.

- Best For: Startups planning to grow quickly.

- FreshBooks

- Cost: Plans start at $15/month (around ₹1,200 INR)

- Why It’s Great: FreshBooks focuses on invoicing and is perfect for freelancers and service-based businesses.

- Best For: Entrepreneurs who prioritize invoicing for startups.

- TallyPrime

- Cost: Starts at ₹600/month

- Why It’s Great: TallyPrime is popular in India for its GST compliance and bookkeeping features.

- Best For: Indian startups needing localized solutions.

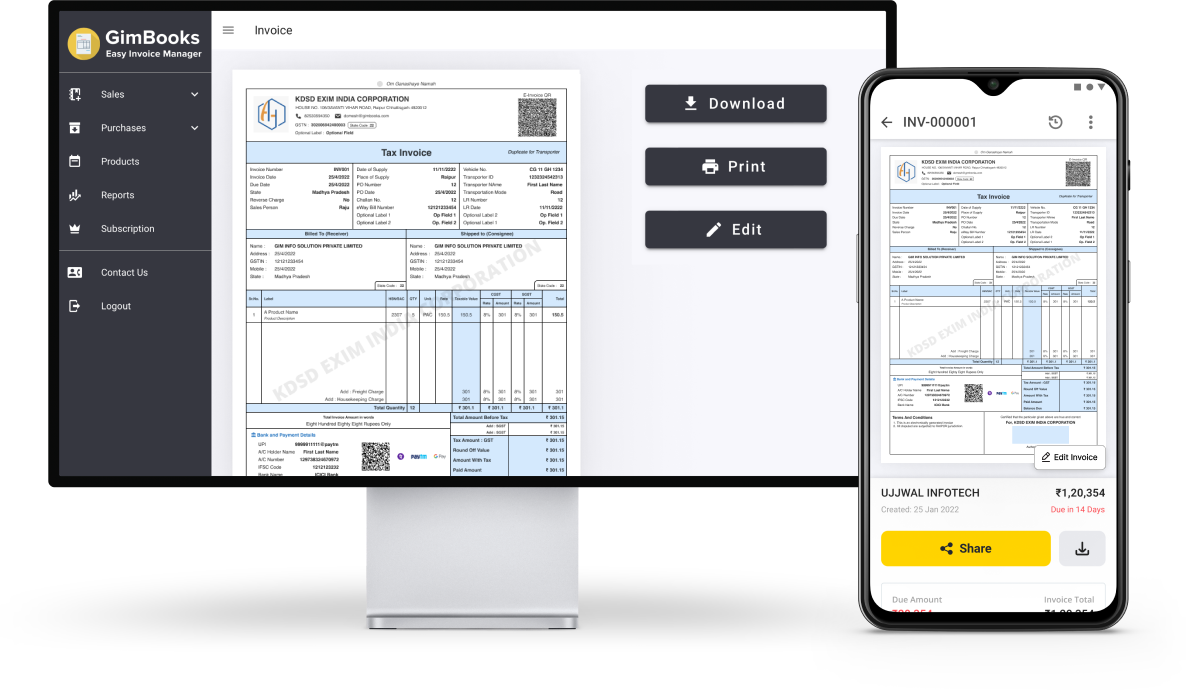

- Gimbook

- Cost: Plans start at $10/month (around ₹800 INR)

- Why It’s Great: Gimbook is designed specifically for startups and small businesses, offering simple invoicing, expense tracking, and customizable reports.

- Best For: Entrepreneurs looking for an intuitive and affordable solution.

Have questions about these tools? Contact us, and we’ll help you choose the right one! Click here: https://bit.ly/4h1SnEf

Benefits of Using Budget-Friendly Software

Affordable billing and accounting tools offer numerous advantages:

- Cost-Effective: These tools are designed for startups, ensuring you get essential features without spending a fortune.

- Time-Saving: Automating tasks like invoicing and expense tracking can save hours each week.

- Improved Cash Flow Management: Tools like Wave and QuickBooks help you monitor income and expenses, ensuring better financial decisions.

- Professional Image: Sending professional invoices builds trust with clients and enhances your brand.

Real-Life Example: How Software Helps Startups

Let’s consider a small digital marketing startup. They used to spend hours each week creating invoices manually and tracking expenses in spreadsheets. After switching to FreshBooks, they:

- Reduced invoicing time by 50%.

- Tracked all expenses in real-time.

- Improved cash flow by ensuring clients paid on time with automated reminders.

This saved them around 10 hours per month, which they used to acquire new clients and grow their business.

Tips for Choosing the Right Software

Here are a few tips to ensure you pick the best tool for your business:

- Start Small: Begin with free or low-cost tools and upgrade as your business grows.

- Check Reviews: Look for feedback from other entrepreneurs to ensure the software meets your needs.

- Try Free Trials: Most tools offer a free trial, so test them out before committing.

- Look for Support: Ensure the software provides customer support to help you with any issues.

Gimbook: The Startup-Friendly Software

Gimbook is a user-friendly and cost-effective billing and accounting solution tailored for startups and small businesses. With its intuitive interface, Gimbook simplifies invoicing and expense tracking, making financial management less daunting. One standout feature is its customizable reporting, which allows entrepreneurs to analyze financial data in ways that suit their unique business needs. At just $10/month (approximately ₹800 INR), Gimbook ensures startups can access professional tools without straining their budgets. For entrepreneurs seeking an affordable yet powerful solution, Gimbook is an excellent choice.

Boost your business efficiency—try one of these affordable tools and get started now! Click here: https://bit.ly/4eMIOHF

Final Thoughts

Affordable billing and accounting software is a game-changer for startups and entrepreneurs. These tools simplify financial management, save time, and help you stay organized, all without putting a strain on your budget. Whether you choose Wave, Zoho Books, Gimbook, or TallyPrime, the right software can make all the difference in your business’s success.

So, why wait? Explore these budget-friendly options today and take the first step toward a more organized and profitable business!