In today’s fast-paced world, managing business finances effectively is essential for success. For small businesses, staying on top of invoices, payments, and records can be challenging. This is where bill generators come in handy. These tools simplify invoicing, save time, and reduce errors. If you’re a small business owner looking to streamline your invoicing process, this blog is for you. We’ll explore the best bill generators, their features, and how they can benefit your business.

Why Small Businesses Need Bill Generators

Managing invoices manually can be time-consuming and prone to mistakes. Small businesses often deal with limited resources, making it vital to work smarter, not harder. Here’s why a bill generator is a must-have tool:

- Saves Time: Instead of creating invoices from scratch, you can use templates and automated features.

- Reduces Errors: Automatic calculations eliminate common mistakes in pricing or tax amounts.

- Improves Cash Flow: Faster invoicing means quicker payments.

- Professional Appearance: A well-designed invoice creates a positive impression on clients.

According to a recent survey, businesses that use invoicing tools experience 30% faster payment cycles compared to those using manual methods. In fact, companies using digital billing systems have reported reducing invoice errors by up to 80%, which significantly improves efficiency.

Key Features to Look for in a Bill Generator

When selecting a bill generator for your small business, look for these essential features:

- User-Friendly Interface: Easy navigation is crucial, especially if you’re not tech-savvy.

- Customization Options: Add your logo, branding, and specific payment terms.

- Automation: Automatic reminders for unpaid invoices and recurring billing.

- Integration: Sync with accounting software like QuickBooks or payment gateways like PayPal.

- Security: Ensure your financial data is encrypted and stored securely.

- Affordable Pricing: Free or budget-friendly plans tailored to small businesses.

Studies indicate that businesses using tools with automation and integration save up to 15 hours per month in administrative tasks, equating to significant cost savings.

Top Best Bill Generators for Small Businesses

Let’s take a closer look at the best options available for small businesses:

- Zoho Invoice

- Why It’s Great: Zoho Invoice offers a user-friendly platform with a free plan suitable for small businesses.

- Features: Customizable templates, time tracking, and multiple currency support.

- Price: Free for businesses with up to 5 clients.

- Fun Fact: Zoho has over 80 million users worldwide.

- QuickBooks Online

- Why It’s Great: This is an excellent choice for those looking for an all-in-one financial management tool.

- Features: Automated tax calculations, recurring invoices, and real-time tracking.

- Price: Starts at $15/month.

- Fun Fact: QuickBooks users report saving an average of 11 hours per month.

- Wave

- Why It’s Great: Perfect for startups and freelancers, Wave is completely free.

- Features: Unlimited invoices, receipt scanning, and accounting tools.

- Price: Free for invoicing and accounting; paid add-ons for payroll.

- Fun Fact: Over 2 million small businesses use Wave globally.

- FreshBooks

- Why It’s Great: Ideal for businesses that need invoicing with robust reporting.

- Features: Expense tracking, project management, and late payment fees.

- Price: Starts at $17/month.

- Fun Fact: FreshBooks claims to reduce time spent on billing by 46%.

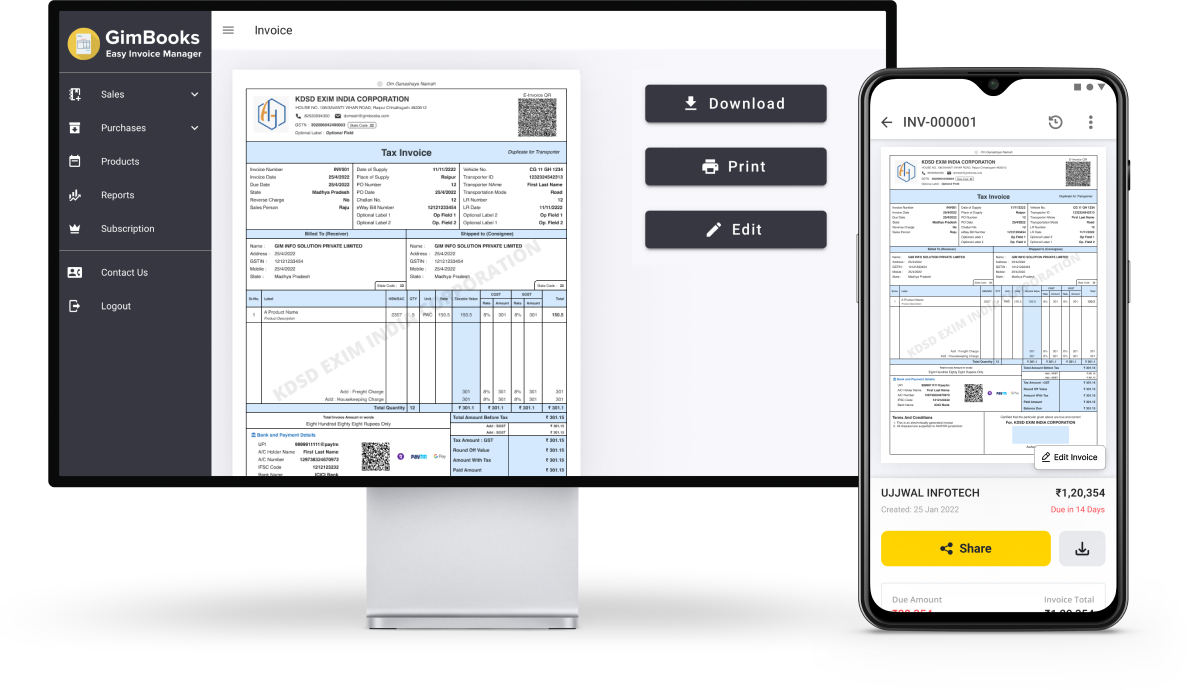

- Gimbook

- Why It’s Great: Gimbook is tailored specifically for small businesses, offering simplicity and powerful features.

- Features: Customizable invoicing tools, seamless integrations, and secure financial management.

- Price: Affordable plans designed for small business needs.

- Fun Fact: Gimbook’s intuitive design ensures ease of use for businesses of all sizes. Businesses using Gimbook have reported a 25% improvement in invoice payment timeframes due to its streamlined features.

Benefits of Using an Online Bill Generator

Switching to an online bill generator brings several advantages:

- Accessibility: Access invoices from anywhere using your phone or computer.

- Real-Time Updates: Keep track of payments and outstanding balances instantly.

- Eco-Friendly: Go paperless and save on printing and mailing costs.

- Data Analytics: Gain insights into your invoicing trends and cash flow.

For example, small businesses using online billing apps reported saving up to 20% in administrative costs annually. Additionally, 70% of businesses using digital invoicing saw a decrease in payment delays by up to 50%.

How to Choose the Best Bill Generator for Your Business

Here are a few steps to help you pick the right tool:

- Assess Your Needs: Determine whether you need basic invoicing or advanced features like integration and automation.

- Set a Budget: Many tools offer free plans or trials; choose one that fits your financial constraints.

- Check Reviews: Read user feedback to ensure reliability and ease of use.

- Test It Out: Most tools offer free trials. Test them to see if they meet your needs.

Gimbook: Your Trusted Partner for Billing Solutions

If you’re looking for an efficient and user-friendly billing platform, Gimbook is worth exploring. Designed specifically for small businesses, Gimbook combines powerful features with simplicity. It offers customizable invoicing tools, seamless integration options, and secure financial management, ensuring your business runs smoothly. With Gimbook, you can save time, reduce errors, and focus on growing your enterprise. Experience hassle-free billing with this reliable online bill generator!

Try Gimbook and Streamline Your Billing Process, https://bit.ly/4eMIOHF

For small businesses, managing finances doesn’t have to be a headache. A good bill generator can save time, reduce errors, and help you get paid faster. Whether you’re looking for free options like Wave or premium tools like QuickBooks Online, there’s something out there for everyone. Invest in the right invoicing tools today and watch your business grow with efficient financial management. Simplify your billing process and focus on what truly matters—your business!