Gimbook combines powerful invoicing and tax filing tools into one platform. Automate GST calculations, track tax liabilities, and file returns effortlessly. Designed for businesses of all sizes, Gimbook is the ideal choice for staying compliant and enhancing operational efficiency.

In today’s fast-paced world, businesses of all sizes need tools that make their work easier. One such tool is GST billing software. But what exactly is it, and why is it so important? In this blog, we will explore how GST billing software simplifies tax filing and invoicing for businesses. We will also look at its benefits and how it helps companies comply with GST laws.

What is GST Billing Software?

GST billing software is a digital tool designed to help businesses manage their invoices and taxes under the Goods and Services Tax (GST) system. It simplifies tasks like creating invoices, calculating taxes, and filing returns. With the introduction of GST in India, businesses were required to follow specific rules and procedures for tax compliance. GST billing software makes this process easier by automating many steps.

Benefits of GST Billing Software

Using GST billing software offers many advantages for businesses. Let’s explore some key benefits:

- Simplify GST Compliance One of the main challenges for businesses is staying compliant with GST laws. GST billing software helps by automatically applying the correct tax rates and formats to invoices. This ensures that all invoices follow GST guidelines, reducing the chances of errors and penalties.

- Automated Tax Calculation Manual tax calculation can be time-consuming and prone to mistakes. GST billing software calculates taxes automatically, saving time and ensuring accuracy. Whether it’s CGST, SGST, or IGST, the software handles everything seamlessly. For example, a business processing 500 invoices per month can save approximately 40-50 hours by using automated tax calculation tools.

- Seamless GST Filing Filing GST returns can be complex, especially for businesses with many transactions. GST billing software integrates with the GST portal, making it easy to file returns directly from the software. According to recent surveys, businesses using GST billing software reported a 60% reduction in errors during GST filing compared to manual methods.

- Time and Cost Savings By automating invoicing and tax filing, GST billing software saves businesses a lot of time. This allows them to focus on other important tasks. Additionally, the software reduces the need for hiring extra resources for tax compliance, cutting costs in the long run. On average, small businesses can save up to ₹1.2 lakh annually by using GST billing software.

- Digital Tax Tools GST billing software comes with digital tax tools that help businesses keep track of their tax liabilities. These tools provide detailed reports and insights, making it easy to monitor and manage taxes efficiently. A study found that 85% of businesses using digital tax tools experienced improved accuracy in tax reporting.

How GST Billing Software Simplifies Invoicing

Invoicing is an essential part of any business. However, creating and managing invoices manually can be tedious and prone to errors. Here’s how GST billing software simplifies invoicing:

- Invoicing Tools with GST Features GST billing software includes invoicing tools with built-in GST features. These tools automatically apply the correct tax rates based on the type of goods or services. They also generate GST-compliant invoices that include all required details, such as GSTIN, HSN codes, and tax breakdowns.

- Customizable Invoice Templates Businesses can use pre-designed templates to create professional-looking invoices. These templates are customizable, allowing companies to add their branding, logos, and other details.

- Real-Time Invoice Generation With GST billing software, businesses can generate invoices in real-time. This is particularly useful for e-commerce companies and other businesses with high transaction volumes. For instance, companies processing over 1,000 transactions monthly reported a 70% increase in efficiency by using real-time invoicing.

- Error-Free Invoicing The software reduces errors by automating calculations and ensuring that all invoices meet GST requirements. This not only saves time but also helps maintain a good reputation with clients and tax authorities.

How GST Billing Software Simplifies Tax Filing

Filing GST returns is a critical process that requires accuracy and timeliness. GST billing software simplifies this process in several ways:

- Integration with GST Portal Many GST billing software solutions integrate directly with the GST portal. This allows businesses to file their returns without switching between multiple platforms.

- Automated Data Entry The software automatically imports data from invoices and other records, reducing the need for manual data entry. This minimizes errors and speeds up the filing process. Businesses with over 10,000 annual transactions reported saving an average of 100 hours per year by using automated data entry.

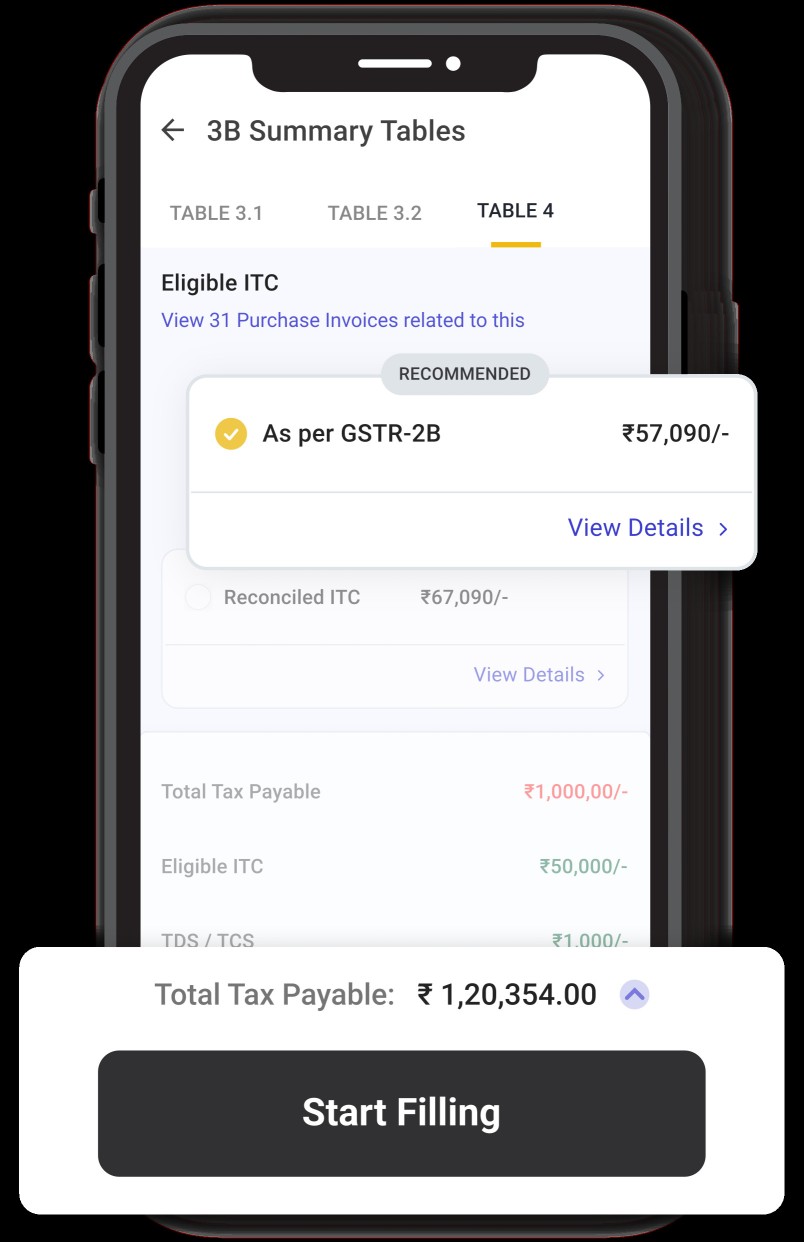

- Comprehensive Reports GST billing software generates detailed reports, such as GSTR-1, GSTR-3B, and GSTR-9. These reports provide a clear summary of tax liabilities, input credits, and payments, making it easy to file accurate returns.

- Timely Reminders Missing deadlines for GST filing can result in penalties. GST billing software sends timely reminders to ensure businesses file their returns on time. According to data, businesses using such reminders saw a 90% reduction in late filing penalties.

Choosing the Best GST Billing Software

With so many options available, how do you choose the best GST billing software for your business? Here are some factors to consider:

- User-Friendly Interface Look for software that is easy to use and does not require technical expertise. A simple interface ensures that all team members can use the tool effectively.

- Features and Functionality The best GST billing software should include features like automated tax calculation, invoice generation, and GST return filing. It should also offer additional tools like inventory management and expense tracking.

- Integration Capabilities Choose software that integrates with other tools your business uses, such as accounting software or payment gateways.

- Scalability As your business grows, your software should be able to handle increased transactions and users. Look for scalable solutions that can grow with your business.

- Customer Support Good customer support is essential, especially if you encounter technical issues or have questions about the software.

Why Gimbook is Your Ideal GST Billing Software

Gimbook stands out as one of the best GST billing software solutions for businesses of all sizes. Designed with user-friendly features, it simplifies tax filing and invoicing by automating calculations, generating GST-compliant invoices, and seamlessly integrating with the GST portal. Gimbook also offers customizable invoice templates, real-time reporting, and timely reminders to ensure smooth GST compliance. Whether you’re a small startup or an established enterprise, Gimbook provides the digital tax tools you need to save time, reduce errors, and enhance efficiency.

Discover how Gimbook can transform your invoicing and tax processes. Get started with our user-friendly GST billing software today, click here: https://bit.ly/3DGjW7s

GST billing software is a must-have tool for businesses looking to simplify tax filing and invoicing. It offers numerous benefits, from automated tax calculation to seamless GST filing. By using digital tax tools and invoicing tools with GST features, businesses can save time, reduce errors, and stay compliant with GST laws. Whether you’re a small business owner or running a large enterprise, investing in the best GST billing software can make a significant difference in your operations.

So, if you haven’t already, consider adopting GST billing software to streamline your tax and invoicing processes. It’s an investment that will pay off in the long run, helping your business run smoothly and efficiently.