While megacities have traditionally been the focus of investment in emerging markets, a significant shift is occurring as investors turn their attention to smaller urban centers. These emerging “secondary cities” are proving to be untapped wells of opportunity, offering unique advantages that their larger counterparts often cannot match.

The Rise of Secondary Cities

The transformation of small towns into vibrant economic hubs is reshaping the investment landscape in developing nations. Two compelling examples of this phenomenon are Lakeshore City and Mega City Gujar Khan, each demonstrating the unique potential that smaller urban centers hold for investors.

Lakeshore City: A Model of Sustainable Growth

Lakeshore City exemplifies how strategic location and focused development can create investment opportunities. With its proximity to water resources and established transportation networks, the city has attracted significant investment in logistics and manufacturing sectors. The lower operational costs compared to nearby metropolises have made it an attractive destination for businesses looking to establish regional operations.

Mega City Gujar Khan: A Vision of Modern Urban Development

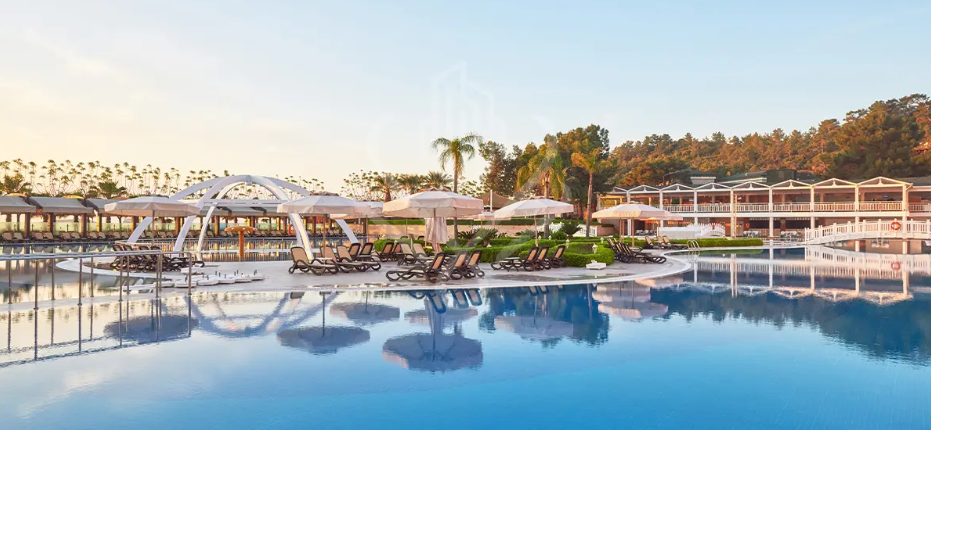

Mega City Gujar Khan represents a new generation of planned urban developments, showcasing how modern city planning can transform traditional areas into sophisticated urban centers. This ambitious project combines:

- Smart city infrastructure with integrated digital systems

- Sustainable urban planning with generous green spaces

- Mixed-use developments that blend residential, commercial, and recreational spaces

- Modern transportation networks designed for future growth

- Advanced utilities and waste management systems

The project demonstrates how emerging markets are leapfrogging traditional development stages to create cities that compete with established urban centers in terms of quality of life and business opportunities.

Why Small Towns Are Attracting Big Investments

Several factors make smaller urban centers particularly attractive to investors:

Lower Operating Costs

Real estate and labor costs in smaller cities typically run 30-50% lower than in major metropolitan areas, allowing businesses to optimize their operational expenses while maintaining quality standards.

Less Competition

Unlike saturated major markets, smaller cities often present opportunities to be first-movers in various sectors, from retail to technology services.

Strong Growth Potential

Many small towns are experiencing rapid population growth and urbanization, creating natural market expansion opportunities.

Government Support

Local governments in smaller cities often offer more attractive incentives to investors, including tax breaks and simplified regulatory processes.

Investment Opportunities Across Sectors

The investment potential in smaller urban centers spans multiple sectors:

Real Estate Development

The demand for both residential and commercial properties in growing small cities presents significant opportunities for real estate investors. Planned developments like Mega City Gujar Khan offer early-stage investment opportunities in master-planned communities.

Infrastructure

As these cities develop, there’s a pressing need for improved infrastructure, from roads and utilities to digital connectivity. This creates opportunities for both public and private investment.

Retail and Services

The rising middle class in these cities represents an underserved market for modern retail experiences and professional services.

Education and Healthcare

Growing populations create demand for quality education and healthcare facilities, presenting opportunities for specialized investment in these essential services.

Challenges and Considerations

While the potential is significant, investors should carefully consider several factors:

- Initial infrastructure development costs in new planned cities

- The need for longer-term investment horizons

- Regulatory compliance with new smart city guidelines

- The importance of strong local partnerships

- Market absorption rates in newly developed areas

Looking Ahead

The trend toward investment in smaller urban centers is likely to continue as these cities offer unique advantages in terms of cost, growth potential, and market access. Planned developments like Mega City Gujar Khan represent the future of urban development in emerging markets, combining modern amenities with sustainable planning.

Success in these markets requires a thorough understanding of local dynamics and a long-term perspective. However, for those who position themselves early and strategically, these emerging urban centers offer compelling opportunities for significant returns on investment, particularly in master-planned communities that can shape the future of urban living.