Understanding Section 321 of the Customs Modernization Act can significantly simplify the importing process for certain goods. This provision allows goods valued under $800 to enter the United States duty-free and without the formal entry process. It provides a pathway for businesses and consumers to efficiently access a wide range of products.

Many importers benefit from Section 321’s streamlined process, especially small businesses and individual consumers looking to reduce costs and delays. They find that this method of clearance not only saves time but also enhances access to international goods that may otherwise require complex compliance procedures.

As interest in global commerce continues to rise, knowing how to navigate Section 321 customs clearance becomes essential. Understanding the guidelines and leveraging this provision can lead to cost savings and greater efficiency in shipping and receiving goods.

Understanding Section 321

Section 321 provides a framework for duty-free importation of low-value goods into the United States. This section streamlines the customs clearance process, allowing eligible shipments to pass through more efficiently.

Overview of Section 321

Section 321 allows for the importation of goods valued at $800 or less without incurring duties or taxes. This provision applies to shipments received by a single person from a single source on the same day. It aims to simplify the customs process, enhancing the efficiency of low-value shipments.

Merchants can take advantage of this regulation to offer competitive pricing on goods by minimizing import costs. When utilizing Section 321, accurate documentation is necessary to validate the claim of low value. This section is particularly beneficial for e-commerce businesses, enabling them to ship products swiftly.

Eligibility for Section 321 Clearance

To qualify for Section 321 clearance, certain criteria must be met. The goods must be imported for personal use or as gifts, and each shipment must not exceed the $800 threshold. Multiple shipments exceeding this value to the same individual in a single day may be subject to duties.

Additionally, goods eligible must not fall under specific restrictions or prohibitions, such as certain types of merchandise like alcohol or tobacco. Importers must ensure compliance with all relevant regulations to avoid penalties. Proper classification of the goods and accurate reporting ensures that the importer remains eligible for this streamlined process.

Benefits of Section 321 Entry

Utilizing Section 321 confers several advantages. Importers benefit from no duty charges for qualifying shipments, making it cost-effective for businesses and individuals alike. This provision encourages small-scale importation, promoting e-commerce growth and accessibility.

Furthermore, the expedited clearance process reduces wait times for shipments, enhancing customer satisfaction. The simplicity of filing under Section 321 streamlines the overall logistics for small parcels, enabling businesses to operate efficiently.

By leveraging Section 321, businesses can improve their inventory turnover and reduce operational costs, making this regulation a valuable tool in their shipping strategy.

The Process of Section 321 Imports

Section 321 imports allow for the streamlined entry of goods valued at $800 or less into the United States. Understanding the specific process helps to facilitate compliance and efficiency in customs clearance.

Documentation Requirements

For Section 321 imports, accurate documentation is crucial. Importers must provide specific information such as:

- Description of goods: Clear and detailed descriptions help customs officials process the shipment.

- Value declaration: The declared value should not exceed $800 to qualify.

- Invoice or receipt: A commercial invoice or receipt must accompany the shipment to validate the transaction.

Additionally, any shipment that includes multiple packages under Section 321 should contain a consolidated invoice. This ensures that customs can verify the total value is compliant with the threshold. Missing documentation can lead to delays and increased costs.

Customs and Border Protection Procedures

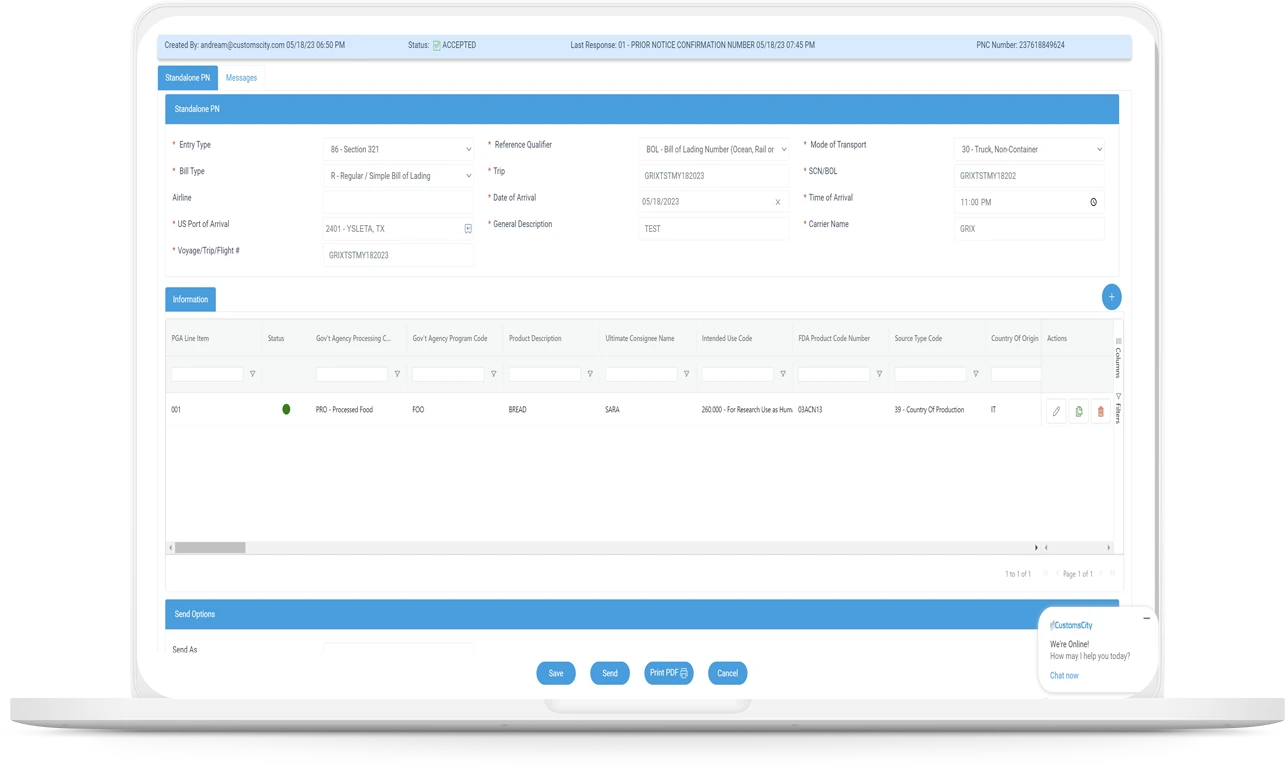

Customs and Border Protection (CBP) has established procedures for processing Section 321 imports. Initially, importers must submit their shipments electronically. This includes:

- Filing entries: Submitting the required documentation through the Automated Commercial Environment (ACE).

- Risk assessment: CBP uses a risk-based approach to decide which shipments require further examination.

Once submitted, CBP reviews the entries and may either accept them or request additional information. If accepted, goods can proceed without delay. It is important to keep in mind that shipments may still be subject to random inspections to ensure compliance with regulations.

Common Challenges and Solutions

Importers may face several challenges during the Section 321 process. These include:

- Incorrect documentation: Submitting incomplete or inaccurate paperwork can cause delays.

- Misunderstanding eligibility: Some importers assume all low-value shipments qualify, but additional items may affect eligibility.

To address these challenges, importers should implement systematic checks of documentation before submission. Engaging a customs broker can also provide expertise on compliance and eligibility criteria, reducing the risk of errors and expediting the clearance process. Adopting these proactive measures can significantly streamline imports under Section 321.