The 2024 Access50 Extended Report shows how resilient the access leasing industry is, demonstrating sustained expansion in the face of major obstacles, particularly in Europe. In addition to offering important insights into the performance of the world’s biggest access equipment and telehandler rental firms, this year’s data demonstrates the industry’s capacity to adjust to changing economic situations. Based on fleet size, Access International’s rating provides a unique look at the dynamics of an industry important to international infrastructure, industrial, and construction projects.

United Rentals Holds Strong Despite Horizon’s Rapid Rise

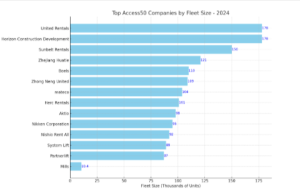

United Rentals is still the largest access rental firm in the world, ranking first on the 2024 Access50 list. Its fiercest rival, though, is Horizon Construction Development, whose fleet grew by an astounding 35.6% to 178,000 units.

Due to its quick expansion, Horizon moved up from third to second position, almost missing out on first place. This achievement is noteworthy since it is the first time a Chinese rental company—typically Sunbelt Rentals—has placed second.

Chinese businesses have a reputation for growing rapidly in recent years, sometimes increasing their fleets by 200%. Even as this growth rate has slowed, businesses such as Zhejiang Huatie, which now ranks fourth with 121,000 units, recorded a 56% gain. The top 25 Chinese rental businesses currently oversee 372,271 MEWPs (Mobile Elevating Work Platforms), a 26% rise from the year before.

The market for access rentals in China is starting to slow down despite its expansion. Two years ago, growth rates were in the double digits; now, forecasts indicate growth will be flat or negative until 2027.

Economic Uncertainty in North America and Europe

Large rental businesses in North America are diversifying their range more and more in an effort to lessen their reliance on the cyclical construction industry. This tendency is best shown by United Rentals, which makes investments in specialist rental businesses in industries other than construction, such as industrial, environmental, and energy.

The business has also been gradually entering the European market; most recently, it opened a fourth facility in the UK and purchased EQIN, a firm established in the Netherlands. This change is consistent with United Rentals’ plan to establish more reliable sources of income during periods of market fluctuation. The new facility is helping small businesses and heavy equipment suppliers to expand their business range.

In the meanwhile, after acquiring the access rental expert Riwal, Boels Rentals moved up from ninth to sixth place in Europe. The present state of the European market, where access equipment costs have gone up, rental rates have gone down, and financing has grown more difficult, is reflected in this marketing. Despite these hindrances, Boels’ action is an intentional attempt to increase its presence in Europe.

German Market Consolidation: System Lift and Partnerlift

System Lift and Partnerlift have played a major role in the consolidation of Germany’s fragmented rental sector. These cooperatives provide centralized services including equipment procurement and legal assistance bringing together several small, family-run businesses in Germany, Austria, and Switzerland. Because of this partnership, both businesses are able to keep up their outstanding Access50 rankings, coming in at 16th and 17th, respectively. System Lift reported a 9% rise in rental sales in 2023, hitting a record turnover of €300.7 million, despite economic conditions.

South America: Mills Expands Beyond Access Rental

Mills is still the biggest rental firm in Brazil and is ranked 22nd on the Access50 list in South America. Mills is a specialized access firm that has dabbled in general equipment rental, in contrast to several of its international competitors. By investing in earthmoving equipment, it increased income by 25% in 2023 despite reducing its MEWP fleet by 3.6%.

Diverse Strategies in a Competitive Landscape

The 2024 Access50 Extended report offers a comprehensive view of the access rental sector’s performance amid challenging economic conditions. The top 10 companies remain largely unchanged, though internal shifts reflect regional and global trends. As the graph below shows, North America and Europe continue to dominate the sector, with Asia led by China, making significant strides. Australia, South America, and the Rest of the World regions hold smaller but growing shares.

This bar graph represents the number of top access rental companies by region, highlighting the dominance of North America and Europe while showcasing Asia’s rise due to rapid growth in China. The stable presence of Asian countries and emerging growth in South America indicate that diverse regional dynamics are shaping the global access rental market.

Future Outlook

The future of the access leasing sector is complicated. It’s possible that China’s fast development may slow down more and stabilize over the next years. In order to reduce cyclical risks, North American businesses like United Rentals are probably going to expand their non-construction portfolio. Europe’s market consolidation, meanwhile, points to a resilient approach amid trying economic times.

One pattern emerges from the diverse geographical dynamics: the access rental sector has demonstrated its capacity to adjust to changing market conditions. The Access50 list will keep changing as businesses look for new development opportunities and enter developing markets, showcasing the industry’s inventiveness and tenacity.

Conclusion

In the face of economic challenges, the 2024 Access50 Extended study highlights the access rental sector’s adaptation, resilience, and development potential. The sector is well-positioned to withstand future storms and seize new possibilities thanks to the creative initiatives being implemented by regional leaders like United Rentals, Horizon, Boels, and Mills. This special ranking is a great way to learn how the biggest access rental firms in the world deal with a changing environment.